International Holding Company (IHC.AD) is making headlines again. Shares in the Abu Dhabi-listed group have risen nearly 900% since 2021, giving it a market value of $245 billion, but left outside observers scratching their heads. While last week’s formation of a new spinoff called 2PointZero might seem like a way to aid transparency, it’s actually more of the same.

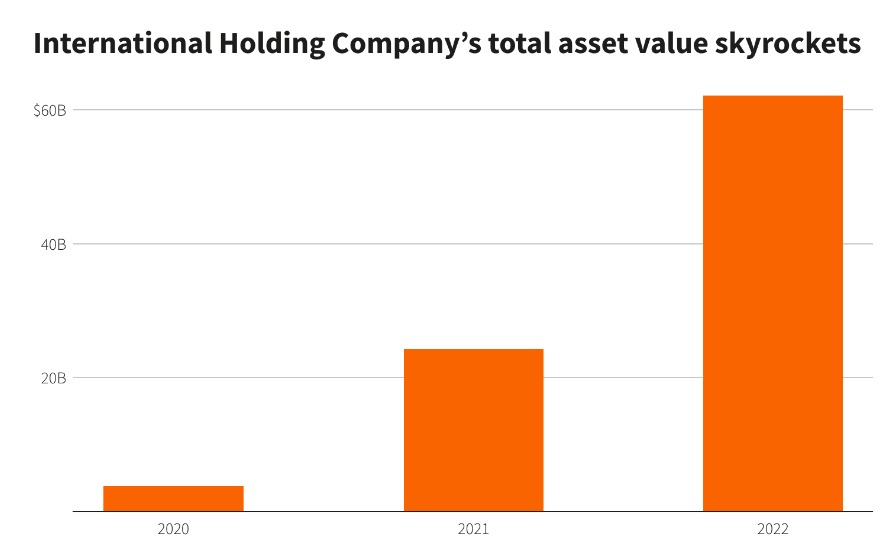

IHC’s many companies do everything in the United Arab Emirates from operating cinemas, to running spas, to importing food. But instead of building these businesses from scratch, the company takes over assets mostly from its 61% shareholder Royal Group, a family office of the Abu Dhabi royal family which is led by Sheikh Tahnoon bin Zayed al-Nahyan, UAE President Sheikh Mohammed bin Zayed al-Nahyan’s brother. That’s one reason behind the dramatic rise in value of IHC’s portfolio from $3.8 billion to $62 billion in 2022, in just two years.

Following its latest deal IHC will hold an 87% stake in 2PointZero, adding $27 billion of assets that includes private investment managers and crypto miner Citadel Technologies to its portfolio. On the face of it, the process is similar to Abu Dhabi National Oil Company’s long-term strategy of spinning off bits of itself via initial public offerings or part-sales.

That analogy doesn’t quite work, though. ADNOC’s sales raised cash from international investors and its listings involved foreign banks, traditional book-building and price ranges that helped outside investors assess deal valuations. Despite owning over 10 companies on the local exchange – including Pure Health (PUREHEALTH.AD), listed last month – IHC’s stock market forays simply issue a price on the bourse, and don’t use external banks as advisers. It also has a small free float.

Read more: reuters.com

Photo: reuters.com

Leave a Reply