A US citizen established front companies in Iran, the UAE and Panama, purchased oil tankers and used false shipping documents to carry out two multi-year schemes to evade sanctions on Iranian petroleum trade, US authorities say.

The US Department of Justice says Behrouz Mokhtari, a 72-year-old Virginia resident with ties to Tehran, pleaded guilty to two conspiracies to violate sanctions on Iranian exports of petrochemical products.

One scheme operating between March 2018 and September 2020 involved Mokhtari using several businesses he controlled in Iran and the UAE to move oil products out of Iran by sea and handle the resulting proceeds.

Bank accounts in the UAE were used to process US dollar transactions, the department says. It says Bitubiz FZE, a Sharjah-registered company that appears to be an exporter of chemicals, operated as a “conduit” for the network “to conceal the fact that Mokhtari and his co-conspirators were engaging in financial transactions with, and providing services to, Iranian entities”.

“Bitubiz maintained daily ledgers which recorded the receipt and transfers of funds,” the justice department says. Bitubiz would then credit those sums to an Iran-based company also part of Mokhtari’s network.

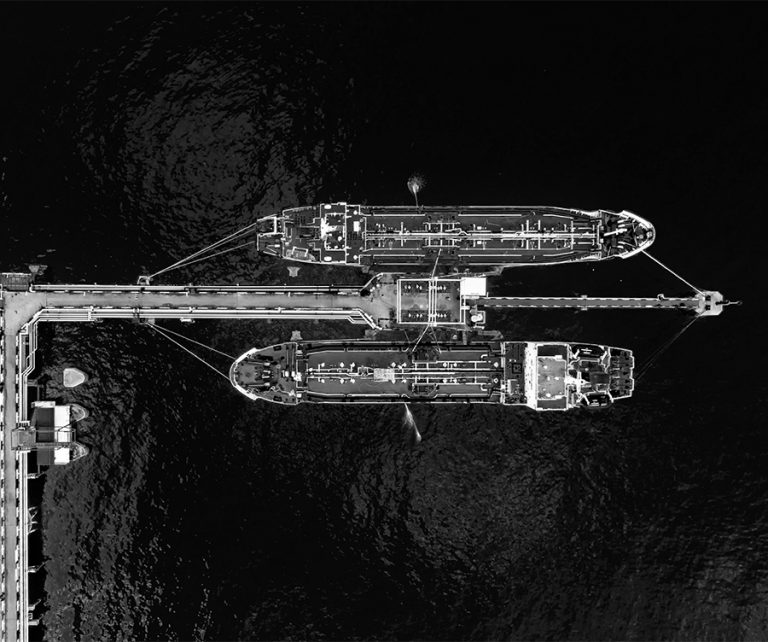

The second scheme, which ran at least between February 2013 and June 2017, involved Panama-based front company East & West Shipping purchasing two liquid petroleum gas tankers to ship Iranian oil.

Ownership of the vessels was then transferred to other entities, and controlled by another Mokhtari-linked firm, Greenline Shipholding.

FBI investigators uncovered emails showing Greenline deployed the two vessels “to transport Iranian petrochemical products from Iranian ports to other locations and to participate in ship-to-ship transfers of Iranian products while on the high seas”.

The network used false shipping documents to hide any link to Iranian goods, the justice department adds.

As part of his guilty plea, Mokhtari must forfeit US$2.86mn in funds as well as assets derived from illicit Iranian oil trading, including a US$1.5mn property in California. He faces a maximum sentence of five years’ imprisonment for each of the two schemes, with sentencing scheduled for April 3.

The case marks the latest in a series of US sanctions enforcement actions with ties to the UAE.

In November, authorities took action against a network of fuel traders linked to the UAE, as well as Singapore and Switzerland, also accused of facilitating the sale of Iranian-origin oil.

That action followed Treasury sanctions against six companies facilitating the sale of Iranian oil to buyers in East Asia, including UAE-based Blue Cactus and Singapore-based Pioneer Shipmanagement, while sanctioned Iranian trade intermediary Trilliance has also had operations in the country.

Read more at : gtreview.com;

Photo: gtreview.com;

Leave a Reply